New Online Credit Application: Enhancing Customer Experience with Billtrust

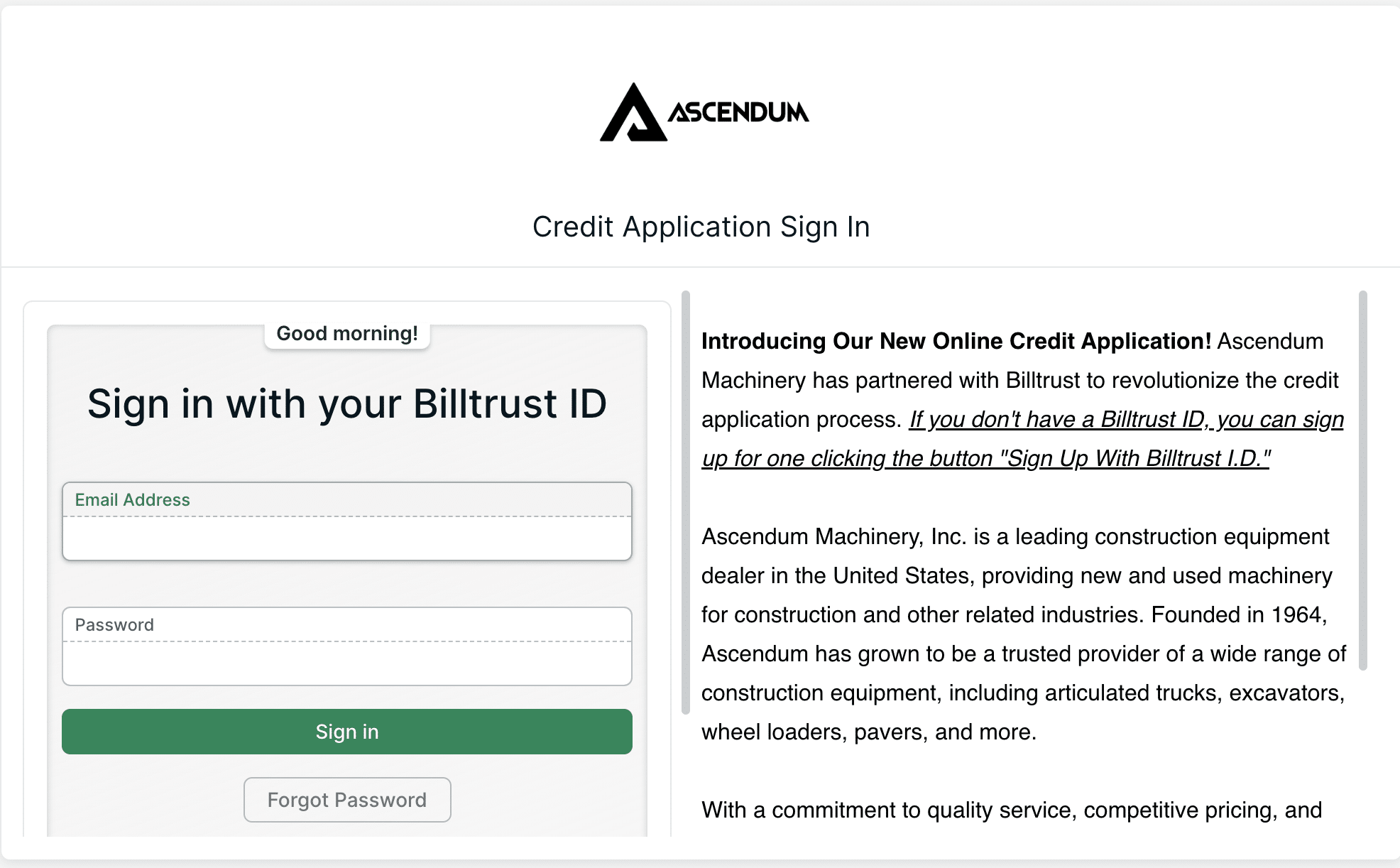

We are thrilled to announce the launch of our brand new online credit application in partnership with Billtrust. This exciting development marks a significant milestone for our company, as it revolutionizes the way we process credit applications and enhances the overall customer experience. Today, we would like to take a moment to provide you with an overview of this powerful tool and highlight its key features.

The introduction of our online credit application allows customers to conveniently and securely apply for credit through our website. By eliminating the need for paper applications, manual data entry, and lengthy approval cycles, this streamlined process offers a host of benefits for both our customers and our organization. Let’s delve into the key features and advantages of our new online credit application.

- Simplified Application Process: Gone are the days of cumbersome paperwork and manual data entry. Our online credit application streamlines the process, making it easier and faster for customers to apply for credit. By leveraging automation, we have simplified the application process, enabling customers to complete it with ease.

- Enhanced User Experience: We understand the importance of a seamless and intuitive user experience. Our online credit application features a user-friendly interface, ensuring a positive impression of our company from the very beginning. By providing a smooth application experience, we aim to foster strong relationships with our customers right from the start.

- Quick Approval Turnaround: Thanks to automated data verification and integration with our credit assessment systems, we can process credit applications more efficiently than ever before. This integration expedites the approval process, reducing the time it takes for approvals and enabling us to provide a quicker response to our customers.

- Secure and Reliable: We have partnered with Billtrust to ensure the highest level of security for customer data. Billtrust employs industry-leading security measures to protect sensitive information and maintain compliance with data privacy regulations. Our customers can have peace of mind knowing that their data is safeguarded throughout the credit application process.

- Real-Time Application Tracking: Transparency and effective communication are vital. With our new online credit application, both customers and Ascendum employees can easily track the progress of credit applications in real-time. This feature minimizes the need for follow-up calls or emails, allowing for a more efficient and transparent process.

- Integration with Existing Systems: To ensure accurate and up-to-date information across our organization, the online credit application seamlessly integrates with our internal systems. By eliminating manual data entry, we enhance data accuracy and efficiency, ultimately benefiting both our customers and our team.

To access the online credit application, customers can simply visit our website and navigate to the “Credit Application” section. They will be guided through a series of user-friendly steps to complete the application and submit it electronically. Our dedicated credit team will promptly process the application and communicate the status directly to the customer.